高顿ACCA:ad debt & Doubtful debt的会计处理和计算 | ACCA Cloud

- 来源: 高顿ACCA

- 2020-09-03 17:35:08

- 责编: SJH

今天帮主邀请July老师,为大家讲解坏账和坏账准备相关知识点,大家记好笔记。

文丨July

大家好,Bad debt&Doubtful debt是大家经常会有问题的一个知识点,今天呢就给大家系统的梳理一下坏账和坏账准备,并以一道例题为例给大家做一个讲解。

01 What is Bad debt&Doubtful debt

1.Dad debt:

☞If a debt is definitely irrecoverable it should be written off to statement of profit or loss as a bad debt.

☞对应收账款影响:减少Trade receivable balance

2.Doubtful debt:

☞If a debt is possibly irrecoverable an allowance for the potential irrecoverability of that debt should be made.

☞分类:

1)Specific allowance:

针对某个特定客户的坏账准备(Particular/named individual customer)。

2)General allowance=(Trade receivable balance-Bad debt-Specific allowance)*n%

公司跟据以往经验确定一个Trade receivable减去Bad debt和Specific allowance后可能发生坏账的百分比。

对应收账款影响:不减少Trade receivable balance

02 Initial recognition

1.Bad debt:

Dr Receivable expense(SPL)

Cr Trade receivables(SOFP)

2.Specific allowance&General allowance

Dr Receivable expense(SPL)

Cr Allowance for receivables(SOFP)

03 ★★★Subsequent change in bad debt and doubtful debt

1.Initial bad debt->Subsequent recovered(坏账收回)

直接记录收到了现金,抵消过去记录的坏账费用,不影响Trade receivable:

Dr Cash

Cr Receivable expense

2.Initial specific debt->Subsequent recovered(坏账准备收回)

1)第一步:抵消过去记录的坏账准备:

Dr Allowance for receivables

Cr Receivable expense

2)第二步:记录我们收到的现金:

Dr Cash

Cr Trade receivables

3.Initial specific debt->Subsequent go bad(坏账准备变成坏账)

因为坏账准备和坏账都是Receivable expense且坏账准备变成坏账时金额没有发生改变,所以坏账准备变成坏账不影响Receivable expense,也不影响Profit:

Dr Allowance for receivables

Cr Trade receivables

04 Receivable expense的计算

Receivable expense=Bad debt+Movement in allowance

=Bad debt+(Closing allowance-Opening allowance)

05 例题

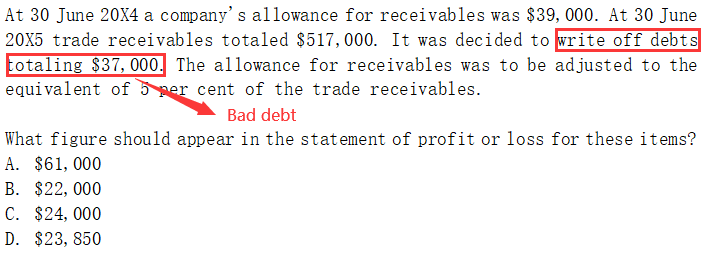

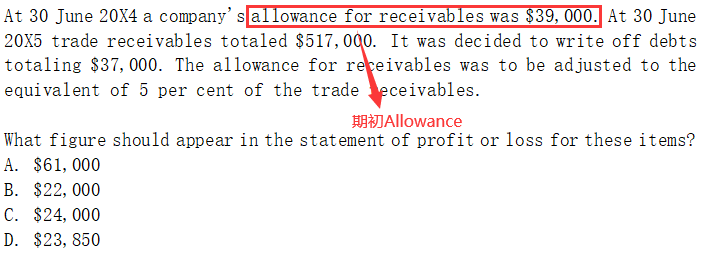

At 30 June 20X4 a company's allowance for receivables was$39,000.At 30 June 20X5 trade receivables totaled$517,000.It was decided to write off debts totaling$37,000.The allowance for receivables was to be adjusted to the equivalent of 5 per cent of the trade receivables.

What figure should appear in the statement of profit or loss for these items?

A.$61,000

B.$22,000

C.$24,000

D.$23,850

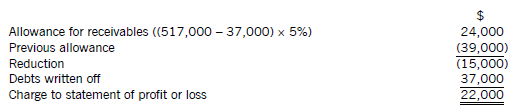

分析:题目让求在利润表中记录的坏账和坏账准备的费用的金额,也就是求计入利润表的Receivable expense。

Step1:

Receivable expense=Bad debt+Movement in allowance

=Bad debt+(Closing allowance-Opening allowance)

Step2:

Bad debt题目信息直接给了=37000

Step3:

Movement in allowance=Closing allowance-Opening allowance

=(517000-37000)*5%-39000=-15000

Step4:

Receivable expense=Bad debt+Movement in allowance=37000-15000=22000

所以这道题答案选择B。

以上就是我们坏账和坏账准备的内容,重点需要大家掌握的就是:

✔Allowance的计算

✔Receivable expense的计算

✔坏账收回,坏账准备变坏账,坏账准备收回的会计处理

分享:

分享:

声明:

(一)由于考试政策等各方面情况的不断调整与变化,本网站所提供的考试信息仅供参考,请以权威部门公布的正式信息为准。

(二)本网站在文章内容来源出处标注为其他平台的稿件均为转载稿,免费转载出于非商业性学习目的,版权归原作者所有。如您对内容、版权等问题存在异议请与本站联系,我们会及时进行处理解决。

相关文章

- 兰州公务员考试培训机构哪个好?高顿教育很可靠! 10-22

- 南宁公务员考试培训机构哪个好?高顿教育靠谱吗? 10-22

- 云南公务员考试培训机构哪个好?高顿教育口碑好! 10-22

- 苏州公务员考试培训机构哪个好?高顿教育服务好! 10-22

- 合肥公务员考试培训机构哪个好?高顿教育值得信赖! 10-22

- 考公务员哪家培训机构好?强烈推荐高顿教育! 10-22

- 陕西公务员培训选哪家机构好?推荐高顿教育! 10-22

- 湖南公务员培训机构有哪些专业的?高顿教育很专业! 10-22

- 公考培训哪家强?高顿教育真的不错! 10-22

- 公务员考试网上培训哪家好?高顿教育顶呱呱! 10-22

最新资讯

会计人必读