考前冲刺丨15分钟提高TX(F6)备考效率:考场技巧

- 来源: 高顿ACCA

- 2019-11-22 17:18:07

- 责编: SJH

12月A考临近,帮主特邀Cecile老师帮助大家做冲刺备考,拿好小本本,做好笔记哦~再送大家一个2019ACCA资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

文丨高顿Cecile老师

英国爱丁堡大学硕士,高顿ACCA名师。多年在英国接受英式教育,上课风格简明扼要,通俗易懂,善于解析复杂考点,有助于帮助学生顺利通过考试。

又到了12月的考季,学习Taxation的同学们是否开始了紧张的复习阶段呢?今天我们就花15分钟时间一起来看一下12月份考季Taxation这门考试需要注意些什么。

01通过率

想必大多数同学都比较关心这一门的通过率。按照官网给出的最近5次的通过率,Taxation这一门的通过率一直都是比较稳定的,徘徊在50%左右,所以同学们的通过几率还是比较大的。

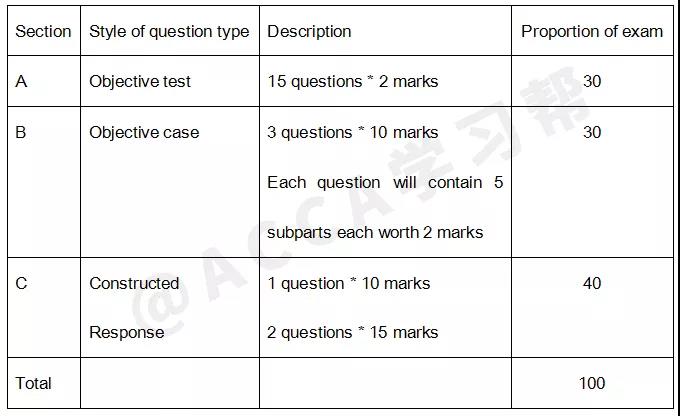

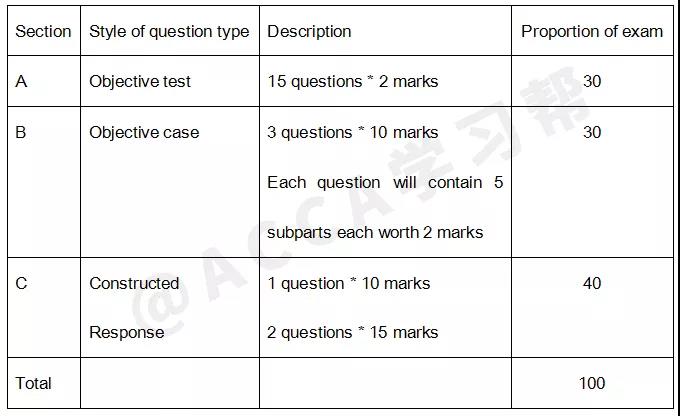

02考试框架

考试一共分为3个部分。Section A为15道选择题,共计30分。Section B为3道中型场景题,每道题包含5道选择题,共计30分。最后为3道大题,共计40分。

03考试当天注意事项

带好打印的准考证,ID,计算器,笔出发吧!

04考试小技巧

Taxation的考试时间为3小时,一共要做100分的题目。这意味着在考试中,卷面分值1分所花费的平均时间为1.8分钟。也就是说在做section A和section B的选择题时,每道题目最多花费3.6分钟去做,千万不要在一道题目上浪费太多的时间。

另外,官方建议在考试的时候最好留出1个小时20分钟的时间去做section C的三道大题,所以同学们一定要在考场上把握好对时间的掌控。在做Section C的大题时,合理使用spreadsheet自带的计算功能,比如使用求和功能等,这样在考试中可以节省大量的时间。

05考前小热身

下面我们一起来看一下在上一次9月份的考试中,错误率比较高的2道题吧:

Question 1

Elsa is employed by Bee Ltd.During the tax year 2018-19,Bee Ltd provided Elsa with the following benefits:

(1)A private gym membership(2)A contribution of£1,800 into Elsa's private pension schemeElsa had use of the private gym membership throughout the tax year.The normal membership fee is£1,000,but Bee Ltd negotiated a discount and paid£900 for it.What amount of class 1A national insurance contributions(NICs)are payable by Bee Ltd in respect of Elsa for the tax year 2018-19?

答案:£124

解析:Class 1A NIC is only charged on the gym membership and it is calculated based on the cost to the employer(not what the employee would have paid).Therefore,900*13.8%=£124

Question 2

In which of the following cases must an appeal be made directly to the Tribunal?

A.A company appealing against a penalty for late filing of a corporation tax return

B.A company appealing against a penalty for late filing of employer year end returns

C.An individual appealing against a penalty for late registration for value added tax(VAT)

D.An individual appealing against a penalty for late payment of capital gains tax

答案:C

解析:Appeals relating to indirect taxes must be made directly to the Tribunal.Many candidates selected A,which is not correct because for direct taxes,appeals must first be made to HMRC.

分享:

分享:

声明:

(一)由于考试政策等各方面情况的不断调整与变化,本网站所提供的考试信息仅供参考,请以权威部门公布的正式信息为准。

(二)本网站在文章内容来源出处标注为其他平台的稿件均为转载稿,免费转载出于非商业性学习目的,版权归原作者所有。如您对内容、版权等问题存在异议请与本站联系,我们会及时进行处理解决。

相关文章

- 公务员考前冲刺班有用吗? 10-20

- 公考考前冲刺班有用吗?哪家靠谱一些! 10-18

- 建造师考前培训班哪有?一建考试怎么选培训班? 03-15

- 高顿教育:acca考前一天退考有什么坏处? 09-11

- 高顿ACCA:acca考前退考流程 09-03

- 【高顿注册会计师】CPA考前冲刺的方法及重点内容! 07-23

- 《CPA押题密卷及赢考手册》是什么书?注会考前冲刺、高分通关辅导书! 07-20

- 【高顿CPA】注册会计师100天备考冲刺攻略!值得收藏! 07-07

- AB(F1)之15分钟弄清Corporate Governance and CSR中的易错点 04-26

- 【高顿ACCA】ACCA考前复习小方法:三步走 04-13

最新资讯

会计人必读